NASA Federal At A Glance

Advanced Banking Innovation

Welcome to NASA Federal Credit Union, the official credit union of space enthusiasts everywhere.

Discover one–of–a–kind banking and financing benefits available to you. Our products and tools are smart— designed to save you both money and time to make your life a little easier. View a few of them below:

Credit Cards from NASA Federal

NASA Federal members can now take advantage of the great credit card benefits. Whether you're looking to consolidate debt, earn points for travel, or maximize cash back on your purchases, NASA Federal has a card for you. Each card comes standard with:

No annual, balance transfer, or foreign transaction fees

Balance Transfers as low as 8.9% APR1 for the life of the transferred balance

$0 Fraud Liability Protection

Supernova Design

Platinum Advantage Rewards

Earn Rewards Points

Earth Design

Platinum Cash Rewards

Earn unlimited 1.5% cash back

Night Lanch Design

Classic Card

Fixed rate, as low as 12.4% APR1

NASA Federal Checking with Smart Perks

NASA Federal Checking with Smart Perks

Checking with Smart Perks is an innovative checking account that provides you with money savings and peace-of-mind personal protection benefits. Plus, enjoy:

- - Get direct deposits up to 2 days earlier with EarlyAccess™ Payroll

- - Waive one NSF fee per month with Elite Checking

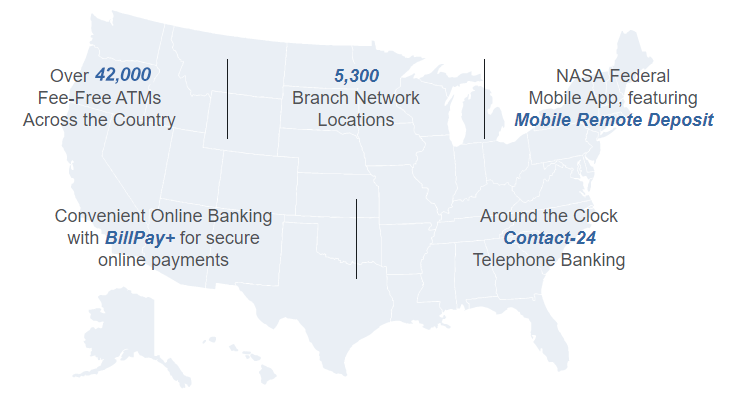

- - Access over 42,000 fee-free ATMs and 5,400 shared branch locations nationwide

- - Earn up to $250 cash back every year on everyday debit purchases

- - Free monthly access to your Credit Score

Mortgages & Equity to Make Dreams Come True

Whether you’re buying your first home, making your next move, refinancing, or looking to tap into your home's equity, NASA Federal has the flexibility, options, and features that can make it a reality.

MORTGAGE OPTIONS

- Mortgage Purchase

- - $0 Down, No PMI Mortgages

- - Fixed-Rate Mortgages

- - FHA Loans

- - VA Mortgages

- - First-Time Home Buyer

- - HomeReady Mortgages

- - Reverse Mortgages

- Mortgage Refinance

- - 95% Cash-Out Refinance

- - Standard Refinance

HOME EQUITY OPTIONS

- Home Equity Perks

- - No points, closing costs2 or fees

- - Access up to 95% of your home's value up to $150,0003 or 85% up to $400,000

- Home Equity Loans

- - Fixed rates as low as 6.25% APR4 (60 months)

- - Terms up to 240 months

- Home Equity Line of Credit (HELOC)

- - Variable rates as low as 6.50% APR5

- - Easy access to funds anytime

Simplify the Auto Loan Process

Whether you're buying a new or used car, or refinancing from another lender, we can help simplify the auto loan process. Take advantage of rates as low as 4.84% APR,6 flexible terms up to 84 months, quick approvals and personal service.

AUTO REFINANCE

Refinance with NASA Federal and you could save an average of $87 each month.7 That’s up to $1,044 of extra cash in your pocket per year and you'll enjoy no payments for the first 60 days.8

NEW & USED AUTOS

Increase your negotiating power at the dealership with a pre-approved auto loan. Plus, enjoy no payments for the first 60 days.8

Check your rate in just 2 minutes – there's no impact to your credit score.

Fixed-Rate Personal Loans as low as 7.94%9

Borrow up to $30,000 to consolidate bills and other balances into one easy monthly payment. You choose the terms, so you'll know exactly when your loan will be paid off!10 Plus, enjoy:

- - Low, fixed monthly payments

- - No hidden, prepayment, or origination fees

- - No payments for 45 days11

- - Fast funds - receive in as little as 2 days12

- - 12-84 month terms9

High Yields On Your Deposits

Start enjoying the highest yields in the nation with a cetificate from NASA Federal.13 They work like a traditional bank CD, typically earn you a better rate of return than savings or money market accounts, and are federally insured by the NCUA. Minimum deposit starts at just $10,000.**

Nationwide Access & Convenience

Helpful Tips to Get Started

![]()

Be sure to visit our home page at www.nasafcu.com to get a feel for what we're all about and browse the complete list of products, services, and perks we can offer you.

![]()

To apply online for NASA Federal products and services, you must first become a member. Simply select your membership eligibility and products you'd like to open.

![]()

We're here to help. If you need assistance or have questions, please call 1-888-NASA-FCU (627-2328) to speak with a knowledgeable representative.

Membership and eligibility required.

1 APR=Annual Percentage Rate. Eligibility and Membership in NASA Federal Credit Union required. All offers subject to credit approval. This limited-time offer is subject to change at any time without notice. See Terms and Conditions for additional details.

2 No closing cost offer available one time only per property and for primary residence only. Closing costs must be repaid if line is closed before 36 months. For loan amounts of $100,000, closing costs typically range between $1,200 and $2,100. Closing costs can vary based on the location of the property and the amount of the Loan.

3 Amount is capped at $150,000 for loans or lines of credit up to 95% of the home's value and is only available in: CO, CT, DE, DC, FL, GA, MA, ME, MD, MN, NC, NH, OR, PA, RI, VA, VT, WA, and WV. Home Equity Loans and Lines of Credit not available in AK, HI, IA, NJ, NY, and TX.

4 APR = Annual Percentage Rate. APR is based on evaluation of applicant's credit and on associated loan-to-value (LTV) ratio. Your actual APR may vary.

Fixed Equity Loan Example: A $50,000 loan at 6.50% APR for 60 months would have an estimated monthly payment of $978.31. Payments shown do not include taxes or insurance, so your payment may be greater. Other restrictions apply.

5 APR = Annual Percentage Rate. Variable rate as low as Prime minus 0.25%. 4.00% Floor Rate regardless of a lower Prime Rate. The APR is a variable rate and is based on the Prime rate as disclosed in The Wall Street Journal plus or minus a margin based on your credit history. The rate is subject to change. Maximum APR is 18%. For loan amounts of $100,000, closing costs typically range between $1,200 and $2,100. Closing costs can vary based on the location of the property and the amount of the loan.

Payment Example: A $100,000 loan at 8.25% APR for 20 years would have an estimated payment of $852.07. Payments shown do not include taxes or insurance, so your payment may be greater. Other restrictions apply.

6 APR = Annual Percentage Rate. APR is based on an evaluation of creditworthiness, so your rate may vary. Credit approval required. Membership and eligibility requirements apply. The refinance of an existing NASA Federal Credit Union fixed-rate loan is permitted one time only with a required $1,000 cash out. Verification of current rate is required. The minimum that can be refinanced is $5,000. Rates are higher for older model cars. The APR for model years 2016 - 2021 are 1% higher and model years greater than 10 years (≤ 2015) are 2% higher than the quoted floor or as low as rates. Payment Example: A $20,000 auto loan financed with NASA Federal at 5.44% APR for 63 months will have a monthly payment of $365.66.

7 Monthly payment reduction claim is based on average payment reduction our members experience with their new loan (same term or longer) disbursed between 1/1/2025 – 5/31/2025, compared to their prior monthly loan payments. Monthly payment reduction may result from a lower interest rate, a longer term or both. Your actual savings may be different.

8 The loan will still accrue interest during the 45-day deferral period.

9 APR = Annual Percentage Rate. APR is based on the evaluation of creditworthiness. Rates are subject to change at any time without notice. Special offer floor rate is 7.94% APR for up to 60 months and is reserved for highly qualified individuals. The special offer floor rate for terms of 61-84 months is 8.94% APR. Your actual APR may vary. Membership eligibility requirements apply. Subject to credit approval. Refinance of existing NASA Federal Credit Union fixed-rate loans permitted one time only with a required $1,000 cash out. Maximum aggregate unsecured credit limits cannot exceed $50,000 with NASA Federal Credit Union. This limited-time offer is subject to change at any time without notice.

Payment Example: A $10,000 personal loan financed with NASA Federal at 7.94% APR for 60 months will have a monthly payment of $202.48.

10 Your loan maturity date may vary if you participate in skip-a-payment or if you pay more or less than the amount reflected in your payment schedule.

11 The loan will continue to accrue interest during the 60-day payment deferral period.

12 Funds will be issued upon receipt of all required loan documents.

13 All APYs current as of February 1, 2026. Comparison rates are sourced from FDIC.gov.

**A minimum $10,000 of new funds brought from an external source required to open special certificates. Early withdrawal penalties apply and may reduce earnings. Credit Union reserves the right to limit deposits into this special Certificate. This limited-time offer is subject to change at any time without notice. Special 9-month Certificate renews automatically to a standard 6-month term at the rate in effect at the time of renewal unless instructed otherwise. Special 15-month Certificate renews automatically to a standard 12-month term at the rate in effect at the time of renewal unless instructed otherwise. Special 49-month Certificate renews automatically to a standard 48-month term at the rate in effect at the time of renewal unless instructed otherwise.

Confidential information such as account numbers and social security numbers should not be sent by email for security reasons. Instead, please contact us directly at 1-888-NASA-FCU, send us a secure message through Online Banking or Mobile Banking, or visit your nearest branch.

You are now leaving nasafcu.com and entering a third party website that is not part of NASA Federal Credit Union.

The content you are about to view is produced by a third party unaffiliated to NASA Federal Credit Union. NASA Federal takes no responsibility for the content of the page.