Deposit Checks On-the-go with a Quick Snap-n-send!

Remote Deposit makes it easy to deposit your checks from anywhere in the galaxy – anytime! No more running to the branch or mailing in your checks.

Here’s How It Works:

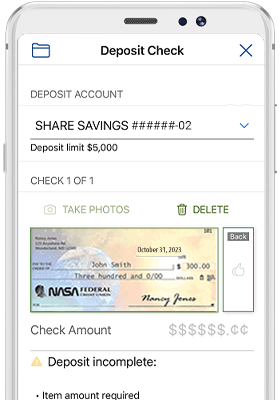

- Download the NASA Federal Mobile App from the appropriate link below.

- Tap the Deposit Icon and agree to the terms and conditions.

- Snap a photo of your check and submit your deposit — it’s that easy.

If you want to scan your checks instead, you can do that right from your computer or scanner.*

Remote Deposit Enrollment Form

REMOTE DEPOSIT FAQs

What can we help you with? Answers to some of our most commonly asked questions are below.

How do I enroll in Remote Deposit?

Members who are prequalified for the Remote Deposit Service will have the Remote Deposit option displayed within the Tools & Services menu in Online Banking and within the Mobile Banking App after accepting the remote deposit agreement. Members without the Remote Deposit option in Online or Mobile Banking may complete an enrollment application above, or may contact us at 1-888-NASA-FCU (627-2328). Eligibility for Remote Deposit is subject to Credit Union approval.

What fees are charged to use Remote Deposit services?

Personal account holders will enjoy free access to the Remote Deposit Service, while Business account holders will incur a per-check deposit fee. Please review our Business Account Fees for more information.

I downloaded the App, but it's asking me for a username and password. How do I get a username and password to log in?

Simply click the "New User?" link and complete the registration process. You'll be asked to create a unique username and password to access both Online and Mobile Banking.

How should I endorse checks that I submit through Remote Deposit?

The following must be included on the back of the check:

- Your name (i.e., signature)

- Date of deposit (mm/dd/yy)

- The words “NASA FCU for deposit via Remote Deposit only”

PLEASE NOTE: If the back of the check is not properly endorsed, NASA Federal reserves the right to reject the check for deposit. Please review the Digital Banking Services Agreement for more details.

How many checks can I deposit using the Mobile Banking App?

You can deposit as many checks as you'd like up to your personalized deposit limit. However, you can only deposit one check at a time.

What should I do with the check once it has been scanned?

Please store your check(s) in a safe place for 45 days from the date of your deposit. In the event of a deposit dispute, NASA Federal Credit Union may require presentation of the original check to settle the dispute. After 45 days, you may securely destroy the check.

*Twain compliant scanner required.

Remote Deposit is available to qualified members* via Online Banking (using a desktop scanner) or by downloading the free Mobile Banking App from Apple's App Store℠ or from the Google Play™ for Android. If you don't see the Remote Deposit option available in Online Banking, or you cannot use the Mobile Banking App, request Remote Deposit today to enjoy making deposits anytime, anywhere.

Eligibility for Remote Deposit is subject to Credit Union approval. Remote Deposit is free, however, usage rates from your mobile carrier may apply when using the Mobile Banking App.

iPhone® is a trademark of Apple, Inc., registered in the U.S. and other countries. App Store is a service mark of Apple, Inc. Android™ and Google Play™ are trademarks of Google, Inc. NASA FCU is not endorsed, sponsored, affiliated with or otherwise authorized by Apple, Inc. or Google, Inc.

Confidential information such as account numbers and social security numbers should not be sent by email for security reasons. Instead, please contact us directly at 1-888-NASA-FCU, send us a secure message through Online Banking or Mobile Banking, or visit your nearest branch.

You are now leaving nasafcu.com and entering a third party website that is not part of NASA Federal Credit Union.

The content you are about to view is produced by a third party unaffiliated to NASA Federal Credit Union. NASA Federal takes no responsibility for the content of the page.